The global high-net-worth individual population rose by 5.1% in 2023, and their wealth grew by 4.7%, according to Capgemini’s 2024 World Wealth Report.

Population growth across different HNWI wealth bands was highest for the so-called ‘millionaires next door’, described having $1 million to $5 million in assets. Ultra-high-net-worth individuals (UHNWIs) were the most concentrated among the HNWI wealth bands, however.

Capgemini reported that this group held over 34% of the total HNWI wealth but represented just 1% of the total population. They were also found to be more engaged in their investment strategy than any other wealth bands.

It is perhaps unsurprising then that Capgemini found that UHNWIs prioritize value-added services, with 78% of them considering them essential to wealth management firm relationships.

UHNWIs were also found to be more changeable in their relationships with wealth management firms, however. According to Capgemini’s survey, 78% of UHWIs indicated they are likely to switch their primary wealth management firm in 2024.

In addition, the number of UHNWI wealth management relationships is on the up. The number of UHNWI wealth management relationships increased from three in 2020 to seven in 2023, and that means the competition is growing for UHNWI’s wallets.

So how should wealth management firms seek to retain this highly lucrative wealth band?

Capgemini suggests that personalization is a key marketplace differentiator for wealth management firms that want to attract new clients and retain existing investors. This is because, through personalization, firms can ensure “engagement, trust, and loyalty”.

“Firms that can cultivate stronger client relationships will further solidify their loyalty. Heightened loyalty increases customer lifetime value because loyal clients are likelier to entrust additional assets to the firm and recommend its services to others,” the research firm stated.

And wealth management firms’ relationship managers appear to agree. 65% of relationship managers surveyed by Capgemini said they find having individual profiles that include client preferences, pain points and behavioural tendences “critical” to enable personalized, sound advice.

And yet only 13% of wealth firms said they sent customized communication, according to Capgemini’s survey, with 73% of firm choosing instead to distribute generic communication monthly.

In addition, only 8% of wealth management firms updated client profiles weekly. Instead, 52% conducted monthly or quarterly updates, and 40% update profiles annually or less frequently. As a result, firms find it challenging to keep pace with clients’ evolving demands and fail to meet clients’ desire for personalization.

The evolution of artificial intelligence over the last decade has meant that personalization in wealth management no longer must be a time-consuming or laborious process.

AI can analyse vast amounts of client data quickly, identify trends and make predictions in a timeframe that would be impossible for humans. This can then provide deeper insights into clients’ behaviours and preferences, allowing for wealth managers to provide bespoke investment strategies quicker and easier.

A global survey of 1,491 executives across 16 countries conducted by The Harris Poll for Google Cloud found that most executives aren’t measuring their environmental, sustainability and governance (ESG) metrics.

Only 36% of respondents said their organizations have measurement tools in place to quantify their sustainability efforts, despite 65% agreeing they want to advance these efforts.

Without accurate measurement, however, it’s hard to track progress.

In the face of this problem, more and more businesses are turning to artificial intelligence to improve their ESG reporting. MSCI, S&P Global, and LSEG are already successfully using AI to crawl ESG reports and extract insights.

How would AI work?

AI can sift through large amounts of data and identify trends, risks and opportunities quickly and efficiently. By using AI in their processes, firms are able to streamline their work and review huge quantities of data in a fraction of the time it would take a human analyst.

Using technology such as machine learning and natural language processing to analyse lots of data from a variety of sources, AI can identify patterns and spot any potential problems. Through this, AI could then provide insights into things such as working conditions, diversity metrics, and health and safety concerns.

Alternatively, AI could analyse data from audits, certifications, and reports to pinpoint potential issues in their operations and those of their suppliers. This would allow firms to more easily take action and report on their supply chain, for example.

How would AI help?

The World Economic Forum argues that when corporations can see the entire picture and understand all their ESG metrics properly, only then will they be able produce goals that provide meaningful change.

Not only that but research by IBM suggests that companies with more mature sustainability data capabilities outperform their peers in many key areas. IBM found that these outperformers have a 5% better rate of return on shareholder investment, a 10% higher annual rate of revenue growth and are 43% more likely to outperform peers on profitability.

After the pandemic flipped the world of interaction on its head, most investors got used to some level of digitisation in their relationship with their advisor. But now, more and more investors deciding to cut out the human and embrace the digital entirely.

According to Polaris Market Research, the robo-advisory market is predicted to grow from $7.4 billion in 2023 to a whopping $72.0 billion by 2032. Deloitte predict similarly impressive growth, estimating that $16.0 trillion in assets under management will be managed with the support of robo-advisory services by the year 2025 up from between $2.2 to $3.7 trillion in 2020.

Robo-advisors tend to handle investment management, offering services such as automated portfolio allocation and rebalancing. They use algorithms and inputs from an investor, such as risk tolerance or goals, to offer advice or invest. Their typically low fees and minimal account requirements often appeal to those just starting in their investment journey, but they can also appeal to investors who want a modern, more hands-off approach.

Generational divides

According to Investopedia’s Affluent Millennial Investing Survey, 20% of affluent millennials use robo-advisors, compared to only 9% of investors aged 47 to 54. Their use is most prevalent among 18- to 22-year-olds, however, with 31% of this age group reporting the use of robo-advisors.

Theresa Carey, brokerage expert at Investopedia, explained that robo-advisors are catching on with younger investors because of their relationship to technology.

“This is a generation that grew up with mobile phones in hand, so making those services app-based created a natural draw,” Carey noted.

Despite this, Investopedia found the majority of the affluent millennials it surveyed still reported a preference for human financial advisors.

Perceived value-add

A study conducted by Vanguard looking into human and robo-advice also found a preference for the human. It surveyed more than 1,500 US investors who reported having a human adviser, a digital adviser, or both and discovered that investors had a better perception of human advisory in terms of value-add.

Vanguard found that those working with a human adviser estimated their annual average return was 15%. These same investors believed they would have only seen a 10% return if they had been unadvised. Meanwhile, those with digital-only advice reported perceived average portfolio returns of 24%. Without their digital advice, they expected an annual return of 21%.

Though in terms of absolute performance, this suggests that robo-advised investors believe they achieve higher returns than human-advised investors, Vanguard noted that digital-advised investors tended to self-report being more aggressive in their investments, which could account for this expected outperformance.

In addition, Vanguard’s survey found that robo-advised investors believe they can achieve a large portion of their performance on their own, further suggesting the better perceived value of a human advisor.

The survey found that those with a human advisor, on average, achieved 59% of their financial goals and believed they would have only achieved 43% of their goals had they not had their advisor. Robo-advised investors, meanwhile, achieved 50% of their financial goals and believed they could have achieved 45% on their own.

The median financial goal for both sets of clients was $1 million.

Combining human and robo-advice

Vanguard found that clients preferred human delivery for many advice services. The survey found that this preference was particularly strong around the emotional and financial success components of advice, rather than the portfolio dimension. Services that investors preferred to digital delivery related to functional tasks and portfolio management, such as diversifying investments and management of taxation.

For Vanguard, this suggests advisors should leverage technology to scale their business and focus on strengthening their uniquely human value proposition.

A recent study by SEI looking into the state of productivity within the UK wealth management sector found that wealth managers spend, on average, spend just 43% of their time on value-add tasks such as time in front of clients, investing, or business development.

“Outsourcing can help reduce costs, manual process errors, complexities, and time spent recruiting and training. When done well, outsourcing can significantly impact productivity over time – creating room for growth,” said Jim London, head of SEI’s UK Private Banking and Wealth Management business.

Consumer sentiment has been on the up since we’ve entered the second half of the year.

According to GfK’s long-running consumer confidence index, the UK’s overall consumer confidence score in June was up ten points from the previous year and up three points from the month prior.

Though the score remained in negative territory at minus 14, it was the third month that the headline consumer confidence score in the UK had increased. Joe Staton, client strategy director at GfK, explained that the score was bolstered by UK consumers’ improved expectations for the economy.

But how do financial advisers feel? And what do they think their clients are really feeling?

According to the latest Schroders Pulse Survey, advisers are also feeling sunnier about the economy. The study, conducted between 25 April and 8 May, found that 28% advisers are expecting equity market returns to be higher than historical averages over the next five years.

This is the highest level in the past five years of the annual survey and is well above the proportion of advisers (14%) that think equity market returns will be lower than historical averages.

Growth expectations for the next five years are also positive. 69% of advisers are predicting higher global growth over the next five years, with just 5% predicting growth to trend lower.

Despite the positivity, most advisers still expect a good deal of disruption over the next five years. Just over half of advisers (57%) expect higher disruption related to technological advances, while 73% expect considerable disruption due to geopolitics.

The expectation of geopolitics-related disruption has been on a clear upward trajectory in the Schroders survey since Russia’s invasion of Ukraine and has been exacerbated in recent months by the ongoing conflict in Gaza. In addition, of course, there are elections in 64 countries this year, including the recent UK election and the upcoming US election. These elections will naturally shape the future of geopolitics to varying degrees.

When asked by Schroders what advisers think their clients were most concerned about, capital loss, inflation, generating sufficient income or rising interest rates, there was one clear answer. According to advisers, clients remain most concerned about the prospect of losing capital.

47% of advisers ranked this as their clients’ number one concern, down from a peak of 63% in November 2022. Schroders suggested this downward trend may be a result in calming market volatility and the recent improvement in market sentiment, particularly around the expectations of a ‘soft landing’ for the global economy following periods of stagnant growth.

Inflation ranked was the second biggest concern, with 26% of advisers reporting it as their clients’ top concern.

Rising interest rates were of least concern, meanwhile, with only 10% of advisers ranking it in first place for clients. Schroders suggested that as most adviser’s clients tend to be older and wealthier, many won’t be impacted should interest rates increase mortgage rates.

The general election is just around the corner. But what are the UK’s two largest parties saying about the future of tech policy? We looked through the manifestoes of Labour and the Conservatives to see what they’ve promised.

The Conservatives on tech

In their manifesto, released on 11 June, the Conservatives pledged to increase public spending on research and development (R&D) to £22 billion and maintain R&D tax reliefs.

They plan to continue investing over £1.5 billion in large-scale computer clusters, with the hope that it will allow the UK to take advantage of the full potential of AI and research into its “safe and responsible” use.

The party also promises to double digital and AI expertise in the civil service and accelerate the modernisation of the UK’s armed forced by investing in technology through the Defence Innovation Agency. For the NHS, the Conservatives plan to invest £3.4 billion in new technology, including an NHS App which would act as a single front door for NHS services and the use of AI. Beyond this, the party also promise to replace outdated computers and digitise NHS processes through a Federated Data Platform.

These plans continue the party’s ambition to maintain the UK’s status as a “science and innovation superpower” and leading market for starting and growing a FinTech firm. To ensure this trajectory continues, the Conservatives have also promised in their manifesto to build on the policies set out in the Edinburgh and Mansion House Reforms which aim to drive growth and competitiveness in UK businesses.

Labour on tech

Labour promised in their manifesto that they will create the conditions to support “innovation and growth” in the financial services sector through supporting a “pro-innovation” regulatory framework and technology such as Open Banking and Open Finance.

As part of their plans for innovation in the wider technology sector, Labour have said they want to create a new Regulatory Innovation Office to help regulators update regulation, speed up approval timelines and co-ordinate issues that span existing boundaries.

The party have also expressed a will to ensure that their industrial strategy supports the development of the AI sector, with a commitment to remove planning barriers to new datacentres. They hope that by supporting technologies such as AI they will be able to transform the speed and accuracy of diagnostic services within the NHS. They also plan to create a National Data Library through the use of AI to bring together existing research programmes to help deliver other data-driven public services.

Labour also promises to scrap short funding cycles for ‘key’ R&D institutions in favour of ten-year budgets. They hope this will lead to “meaningful” partnerships within the industry.

Young investors in the UK do not consider managing their wealth a priority, according to a new survey conducted by Invessed in association with YouGov.

The survey asked 2,068 consumers about their attitude towards their financial future. It defined ‘young investors’ as anyone born after 1965. This would include Generation X, millennials and Generation Z.

Invessed found that 42% of young investors were uncomfortable with basic investing principles. Men tended to be more comfortable with investing than women but both genders said they were unlikely to seek professional advice due to high fees and a preference for managing alone.

Over half of respondents (56%) expressed that they did not seek advice due to fees or ‘old-fashioned’ practice.

The data also suggested that the majority of young investors (61%) aren’t actively monitoring their investments. Only 12% use reports to track invests, 6% employ an advisor client portal while 26% use-self investing apps.

What could wealth managers do?

Invessed suggested that wealth managers will need to consider their offering if they want to keep their future client base engaged.

The platform recommended that wealth managers should simplify their language, build financial literacy, encourage good financial habits, and illustrate long-terms benefits to better engage this demographic more effectively.

“A digital-first approach with modern and intuitive client apps and advisory coaching services will appeal to younger investors. It’s also crucial to reduce entry barriers with transparent fees and uncomplicated onboarding processes,” it suggested.

Invessed argued that by embracing these changes, wealth managers could effectively cater to the future generation of wealth holders and ensure their readiness to manage the anticipated $84 trillion wealth transfer from Baby Boomers.

CEO and Founder of Invessed Theo Paraskevolpoulos said: “We believe in facilitating engagement with younger generations. This approach will resonate with them and help increase your assets under management.”

What do wealth managers think?

A growing proportion of advisers are concerned about the impact wealth transferring between generations could have on their business.

According to the Schroders 2023 UK Financial Adviser Pulse survey, 63% are now worried that they could lose business as a result of this, up from 59% the year prior.

Despite this, Schroders noted that attracting younger client did not seem to be a priority for most advisers. The asset management firm said that only 16% of the advisers it survey reported having a differentiated sales and marketing strategy for younger investors. Further, only 25% of advisers are prepared to advise clients with less than £50,000 to invest. In 2019, 52% were prepare to do this.

Industrial Thought Ltd, a group of companies specialised in investment taxation, financial data, and related consultancy services, announces the resignation of its Group CEO, Nuno Godinho, who has taken the decision to step back for personal and family reasons.

There will be no immediate managerial changes within the group, and the decision will not impact the operations of its subsidiaries as each company has its own strong management structure in place.

David Pirrie, Chairman of Industrial Thought Ltd and Founder of Financial Software Ltd (FSL) said: “I would like to thank Nuno for his contribution and share our best wishes. As always, Industrial Thought Ltd. remains firmly committed to meeting its customers’ needs and maintaining the highest level of service. I have every confidence in our highly capable team as we continue to concentrate on developing our core business and serving our stakeholders to the best of our abilities.”

Founded in 2013, Industrial Thought Ltd is the parent company of a group of businesses specialising in investment taxation, financial data, and related consultancy services. Industrial Thought group companies and industry partners form a best-of-breed ecosystem that aims to bring together financial expertise and technology innovation to create a suite of market-leading products and services that enhance the governance and transparency of the wealth industry.

ITL’s story began in 1994 with investment tax specialists Financial Software Ltd (FSL). FSL simplifies the process of investment tax management, analysis and reporting. Its flagship product, CGiX, is trusted by leading members of the UK’s wealth and investment community to accurately calculate their taxable wealth.

FSL’s sister company Raw Knowledge arms the financial services industry with the most comprehensive offshore funds data in the market and offers expert-led end-to-end data consultancy.

Last month, the UK Financial Conduct Authority announced that it intends to extend its Sustainability Disclosure Requirements (SDR) and investment labels regime to all forms of portfolio management services. ITL sat down with Shai Hill, Founder and CEO of Integrum ESG, to discuss what these new rules mean, how wealth managers can comply, and how their platform can help.

Integrum ESG is a specialist ESG ratings and analytics platform, providing exportable data, bespoke reporting solutions, and real-time controversy alerts. ITL has invested £100k in Integrum ESG and has a partnership agreement with the firm.

How will wealth managers be impacted by the new rules?

Shai Hill (SH): Wealth managers will be in direct scope of SDR and will be held responsible even where the management of any assets is carried out by a third-party. If a wealth manager is making no sustainability claims for the services it provides, then it faces no new requirements, but it is of course forbidden from making any claims alluding to sustainability, ESG or positive impact.

If it wants to make sustainability claims, then it must apply to the FCA for one of four labels, depending on the sustainability objective of the managed portfolio.

Do wealth managers need to apply for one of these labels?

SH: If a wealth manager doesn’t want to apply for these labels but still wishes to claim its services have sustainability characteristics, it must produce the same types of disclosures as required for labelled products. It must also produce a statement clarifying why it does not have a label and cannot use sustainable, sustainability, impact or any variation of those terms in its communications.

Some may think they can sidestep these requirements by dropping any sustainability claims for their products and services. But these managers are likely to lose customers. The FCA themselves conducted a survey which revealed 80% of consumers want their investment to do some good, as well as provide a financial return. Which, in our opinion at Integrum ESG, means wealth managers might as well apply for one of these labels.

What do wealth managers need to do to comply?

SH: Wealth managers will be responsible for ensuring that the overall portfolio meets the sustainability claims of the portfolio. Disclosures must show that at least 70% of the portfolio is invested in accordance with the sustainability criteria.

The sustainable portfolio’s assets must be selected with reference to a “robust, evidence-based standard” that is an absolute measure of environmental and/or social sustainability. What these standards are and how they are applied must be disclosed to existing and prospective clients and their measurement must involve key performance indicators and/or metrics.

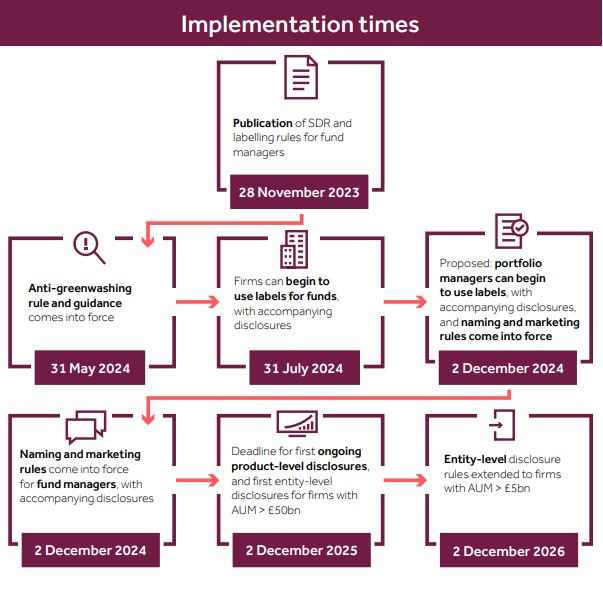

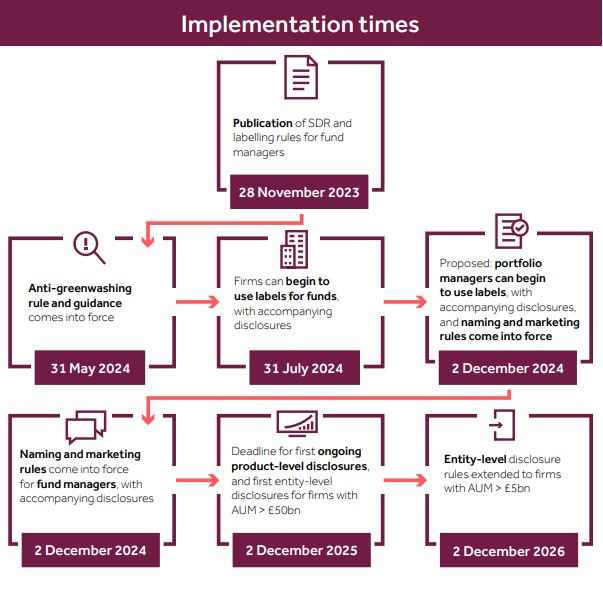

When will wealth managers need to comply?

SH: It is increasingly likely that wealth managers will have to comply with these rules by 2nd December 2024 – a very tight deadline for a demanding new set of requirements, but the FCA seems determined to give PWMs the same deadline as fund managers.

The FCA also seems unsympathetic that compliance with SDR will bring added costs to most – even setting out cost estimates for PWMs – and noting that it intends to monitor a range of sources to ensure compliance.

Assuming most wealth managers will want to wait for publication of the final rules, they will need to begin their preparations in what is likely going to be a stressful Autumn 2024.

How can wealth managers best prepare for SDR?

SH: If they are looking to claim sustainability characteristics, they will need to bring more ESG know-how in house, and draft new pre-contractual disclosures. In terms of external input, they will need to move beyond headline ESG ratings and secure access to ESG data that gives them an understanding of the sustainability characteristics of a fund’s underlying assets. This ESG data will need to include KPIs for the assets that are absolute, not relative, and are exportable into client reports.

How can Integrum ESG help?

SH: Our platform gives clear reasoning for its ESG scores, with full visibility into the underlying data. It has been developed by investment professionals, for investment professionals, to solve the problems associated with opaque methodologies and provide complete clarity. As a result, wealth managers can understand and explain a company’s ESG challenges and how it manages those challenges in the market.

Integrum ESG can provide wealth managers with exactly what they need to escape regulatory scrutiny and comply with any investor demand thanks to our exportable granular data and bespoke reporting capabilities.

If you’d like to learn more about Integrum ESG’s offering, get in touch.

At the end of April, the UK Financial Conduct Authority announced that it intends to extend its Sustainability Disclosure Requirements (SDR) and investment labels regime to all forms of portfolio management services.

The decision would bring the rules for portfolio managers more closely in line with those for asset managers. It would include model portfolios, customized portfolios and bespoke portfolio management services.

The financial watchdog argued that by extending the requirements to portfolio managers it would help improve consumer trust, market integrity and minimize greenwashing.

Its consultation closes on June 14 and it plans to publish the final rules in the second half of the year.

What are the proposed rules?

Firstly, if a portfolio manager is making no sustainability claims, then it faces no new requirements. However, under the FCA’s proposed rules, it would then be forbidden from making any claims alluding to sustainability, ESG or positive impact.

If a portfolio manager wants to make sustainability claims, then it must apply to the FCA for one of four labels. These labels depend on the portfolio’s sustainability objective. Further, to use a label at least 70% of the overall portfolio arrangement would need to be invested in accordance with this sustainability objective.

The portfolio’s assets must be selected with reference to a “robust, evidence-based standard” that is an “absolute measure of environmental and/or social sustainability”. It must also have key performance indicators that demonstrate progress towards achieving the sustainability objective.

The four investment labels proposed by the FCA.

If a portfolio manager does not want to apply for one of these labels but still claim that its services have sustainability characteristics, it must produce the same types of disclosures as required for labelled products. It will also have to produce a statement clarifying the reason why it does not have a label.

A portfolio manager that does not want one of the FCA’s labels also cannot use “sustainable, sustainability, impact and any variation of those terms” in any of its communications.

Overseas funds remain out of the scope of the SDR and labelling regime. However, the Treasury have announced their intention to consult on extending the regime to overseas recognized funds.

When would this come into force?

The FCA proposes that the labelling, naming and marketing requirements, and their associated consumer-facing and pre-contractual disclosures, will come into force on December 2, 2024. Product-level disclosures are expected to follow a year later.

Firms with assets under management greater than £50 billion will need to produce entity-level disclosures by December 2, 2025. Meanwhile, firms with AUM greater than £5 billion will have until the same date in 2026.

The FCA said this follows a similar approach to the final rules for fund managers.

The FCA’s proposed timeline for SDR

Three quarters of wealth managers and institutional investors are predicting that tokenisation will be increasingly adopted by fund managers over the next five years, according to new research.

The study, conducted by investment manager Nickel Digital Asset Management, found that 14% expected to see a “dramatic” growth in tokenisation over the next five years. Meanwhile, over four fifths expected decentralised finance solutions to have an impact on the way traditional finance firms do business.

What is tokenisation?

Tokenisation creates digital representations of financial assets, with ownership tracked on distributed ledgers or blockchains. These assets can be everything from equities and bonds to real estate and pieces of art. They can even represent intangible things like intellectual property.

Citigroup have forecast that $4 trillion to $5 trillion of tokenised digital securities could be issued by 2030. A report by Boston Consulting Group and ADDX, however, estimates that the tokenization market could be a $16 trillion business opportunity by the same year.

The technology remains in its infancy, however. Even digital bond issuance – the most common usage for tokenisation in mainstream financial assets – is small. Just $500 million of digital bonds were issued in the year to September 2023, according to S&P Global Ratings. Meanwhile, $6.3 trillion of US bonds were issued in the same period, according to the Securities Industry & Financial Markets Association.

What are the benefits?

One of tokenisation’s most touted benefits is its accessibility. Through tokenisation, an asset can be represented by millions of tokens, creating the ability for fractional ownership. These can then be listed on a variety of exchanges, expanding the potential buyer pool.

Transparency is another key benefit. Due to the public nature of many blockchains, an individual can track and audit all the records of the asset. This feature has the potential to reduce the risk of fraud and increase trust in the market.

Tokenisation can also potentially offer cost-efficiency benefits as the technology cuts out the need for middlemen in various transaction processes.

Lingering concerns

Despite the technology’s promise, over a third of those surveyed by Nickel Digital said more regulatory clarity was needed on decentralised finance in order to engage with it.

31% pointed to a lack of safe custody solutions and 18% admitted they do not have the specialised talent to engage with decentralised finance.

One of the most immediate challenges facing tokenisation is the current regulatory landscape. As the technology is still relatively new, many governments are yet to establish clear regulation. Regulation also varies significantly from country to country.

In the UK, the Financial Conduct Authority has said it was working with the industry to explore the potential uses of fund tokenisation.

It confirmed it would work closely with the government, firms, and other market participants to understand the emerging technologies, their commercial use cases and the potential issues with the UK’s legal and regulatory framework.